|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Bankruptcy Attorney Woodland Hills CA: A Comprehensive Guide to Navigating Financial Distress

When financial challenges become overwhelming, seeking the expertise of a bankruptcy attorney in Woodland Hills, CA, can be a critical step towards regaining control of your financial future. Bankruptcy attorneys specialize in helping individuals and businesses understand their options and make informed decisions.

Understanding Bankruptcy in California

California offers several bankruptcy options, each suited to different financial situations. Understanding these options is crucial for making the right choice.

Chapter 7 Bankruptcy

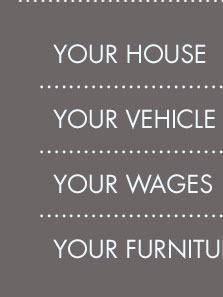

Known as 'liquidation bankruptcy,' Chapter 7 is designed for individuals and businesses with limited income. It involves liquidating non-exempt assets to pay off creditors.

- Eligibility: Means test to assess qualification.

- Process: Filing a petition, automatic stay, liquidation.

- Outcome: Debt discharge after asset liquidation.

Chapter 13 Bankruptcy

Chapter 13 is often referred to as a 'wage earner's plan.' It allows individuals with a regular income to develop a plan to repay all or part of their debts.

- Eligibility: Regular income and debt limits.

- Process: Submission of a repayment plan.

- Outcome: Debt restructuring and repayment over 3-5 years.

Choosing the Right Bankruptcy Attorney

Selecting the right attorney is vital for navigating bankruptcy successfully. Consider the following when choosing a bankruptcy attorney in Woodland Hills, CA:

- Experience: Look for attorneys with a proven track record in bankruptcy cases.

- Specialization: Ensure they specialize in bankruptcy law.

- Client Reviews: Read testimonials and reviews from past clients.

- Consultation: Take advantage of free consultations to assess compatibility.

For those considering other locations, a tampa bankruptcy attorney might be a valuable alternative.

Common Bankruptcy Myths

Misconceptions about bankruptcy can deter individuals from seeking help. Let's debunk some common myths:

Myth 1: Bankruptcy Ruins Credit Forever

While bankruptcy affects credit scores, many individuals can rebuild their credit within a few years.

Myth 2: All Debts Are Wiped Clean

Not all debts are discharged in bankruptcy. Obligations like child support and student loans typically remain.

Frequently Asked Questions

What does a bankruptcy attorney do?

A bankruptcy attorney assists clients in evaluating their financial situations, advises on the best bankruptcy options, and represents them through the legal proceedings.

How much does it cost to hire a bankruptcy attorney in Woodland Hills?

The cost varies depending on the complexity of the case, but most attorneys offer a flat fee for Chapter 7 and a retainer plus hourly rate for Chapter 13.

Can a bankruptcy attorney help prevent foreclosure?

Yes, filing for bankruptcy can halt foreclosure temporarily, providing time to negotiate with lenders.

Exploring options in different states, like consulting a bankruptcy attorney mn, can provide additional insights tailored to specific regional laws.

Havkin and Shrago is an award-winning trial practice that represents creditors, debtors, and trustees in ...

At The Law Offices Of Hagen & Hagen, our bankruptcy services in Woodland Hills include compassionate, approachable assistance with Chapter 7 and Chapter 13 ...

For over 50 years, Cal West Law has fought to protect the rights of people throughout Woodland Hills and Northern California. We strive to build lifelong ...

![]()